Note4Students

From UPSC perspective, the following things are important :

Prelims level: Irrecoverable Carbon

Mains level: Global carbon sinks

Researchers have identified and mapped 139 gigatonnes (Gt) of “irrecoverable carbon” in some of the world’s major forests and peatlands — including the Amazon and the Congo — to avoid catastrophic climate change.

What is Irrecoverable Carbon?

- The concept of ‘irrecoverable carbon’ was introduced in 2020.

- All kinds of ecosystems — lush rainforest, muddy peatland, shady mangroves — contain eons of stored carbon, captured by photosynthesis.

- Per square kilometer, the forests are among the most effective carbon stores in the world; but they’re also some of the most difficult to restore.

- If destroyed, these ecosystems could take decades or centuries to regenerate.

- In other words, the 139 gigatons of carbon contained in these areas are effectively irrecoverable if released due to anthropogenic activities.

- Once released in air, it can be recovered but would take centuries to fully recover or naturally reintegrate.

What is the new research?

- In the new study, researchers have identified and mapped carbon reserves that are “manageable, are vulnerable to disturbance” and cannot be recovered by 2050.

- They held study of peatlands of the Congo Basin and Northern Europe; and in North America, the mangrove swamps of the Everglades and old-growth forests of the Pacific Northwest.

- 2050 has been set as the deadline for taking global carbon emissions to net zero in order for Earth to avoid warming at 1.5-2 degrees celsius above the pre-industrial levels.

- To mitigate such a warming scenario, it is imperative to conserve the ecosystems with 139 Gt carbon.

Key findings

- Amazon is the biggest carbon sink on earth, holding 31.5 Gt irrecoverable carbon.

- Brazil has the second-largest irrecoverable carbon reserves, after Russia that holds 23 per cent of the total irrecoverable carbon outlay in the world.

- The second-largest reserve of carbon, at 132 Gt, comprise the islands of Southeast Asia, with their equatorial rainforests.

- The Congo basin is the third-largest hotspot of irrecoverable carbon with over 8 Gt of carbon reserves, according to the study.

- Australia, which has become a hotspot for wildfires, is home to 2.5 per cent of the world’s carbon reserve along its coastal mangroves and forests in the southeast and southwest.

Why conserve these forests?

- These regions are already being ravaged by wildfires and exploited for resources by mining and oil industries.

- Since 2010, agriculture, logging and wildfire have caused emissions of at least 4 Gt of irrecoverable carbon.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Nord Stream Pipeline

Mains level: Not Much

Germany has warned about severe consequences for the Nord Stream 2 gas pipeline from Russia to Germany if Moscow attacked Ukraine.

Nord Stream 2 Pipeline

- It is a system of offshore natural gas pipelines running under the Baltic Sea from Russia to Germany.

- It includes two active pipelines running from Vyborg to Lubmin near Greifswald forming the original Nord Stream, and two further pipelines under construction running from Ust-Luga to Lubmin termed Nord Stream 2.

- In Lubmin the lines connect to the OPAL line to Olbernhau on the Czech border and to the NEL line to Rehden near Bremen.

- The first line Nord Stream-1 was laid and inaugurated in 2011 and the second line in 2012.

- At 1,222 km in length, Nord Stream is the longest sub-sea pipeline in the world, surpassing the Langeled pipeline.

Why is the pipeline controversial?

- The US believed that the project would increase Europe’s dependence on Russia for natural gas.

- Currently, EU countries already rely on Russia for 40 percent of their gas needs.

- The project also has opponents in eastern Europe, especially Ukraine, whose ties with Russia have seriously deteriorated in the aftermath of the Crimean conflict in 2014.

- There is an existing land pipeline between Russia and Europe that runs through Ukraine.

- The country feels that once Nord Storm 2 is completed, Russia could bypass the Ukrainian pipeline, and deprive it of lucrative transit fees of around $3 billion per year.

- Ukraine also fears another invasion by Russia once the new pipeline is operational.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Gross tax revenue

Mains level: Paper 3- Challenges in achieving 9.5 growth rate

Context

The National Statistical Office (NSO) released the second quarter gross value added (GVA) and gross domestic product (GDP) numbers on November 30, 2021, indicating the pace of economic recovery in India after the two COVID-19 waves.

Strong growth momentum required to exceed pre-COVID-19 levels

- The real GVA for the first half of 2021-22 at ₹63.4 lakh crore has remained below the level in the first half of 2019-20 at ₹65.8 lakh crore by (-)3.7%.

- This difference is even larger for GDP which at the end of first half of 2021-22 stood at ₹68.1 lakh crore, which is (-) 4.4% below the corresponding level of GDP at ₹71.3 lakh crore in 2019-20.

- As the base effect weakens in the third and fourth quarters of 2021-22, a strong growth momentum would be needed to ensure that at the end of this fiscal year, in terms of magnitude, GVA and GDP in real terms exceed their corresponding pre-COVID-19 levels of 2019-20.

- Domestic demand including private final consumption expenditure (PFCE) in the first half of 2021-22 remains below its corresponding level in 2019-20 by nearly ₹5.5 lakh crore.

- This indicates that investment as well as consumption demand have to pick up strongly in the remaining two quarters to ensure that the economy emerges on the positive side at the end of 2021-22 as compared to its pre-COVID-19 level.

Annual growth prospects

- Required rate in second half of 2021-22: To realise the projected annual growth at 9.5% for 2021-22 given both by the Reserve Bank of India (RBI) and the International Monetary Fund (IMF), we require a growth of 6.2% in the second half of 2021-22.

- This will have to be achieved even as the base effect weakens in the third and fourth quarters since GDP growth rate in these quarters of 2020-21 was at 0.5% and 1.6%, respectively.

- Thus, achieving the projected growth rate of 9.5% is going to be a big challenge.

What should be the policy to achieve higher growth rate

- Fiscal support: The policy instrument for achieving a higher growth may have to be a strong fiscal support in the form of government capital expenditure.

- The Centre’s gross tax revenues have shown an unprecedented growth rate of 64.2% and a buoyancy of 2.7 in the first half of 2021-22.

- The Centre’s incentivisation of state capital expenditure through additional borrowing limits would also help in this regard. According to available information, 11 States in the first quarter and seven States in the second quarter qualified for the release of the additional tranche under this window.

- Even as Central and State capital expenditures gather momentum, high frequency indicators reflect an ongoing pick-up in private sector economic activities.

Robust growth in Centre’s gross tax revenue

- The growth in the Centre’s GTR in the first half of 2019-20 was at 1.5% and there was a contraction of (-)3.4% for the year as a whole.

- In the face of such weak revenues, the Central government could not mount a meaningful fiscal stimulus in 2019-20 even as real GDP growth fell to 4.0%.

- In contrast, the government is in a significantly stronger position in 2021-22 since the growth in GTR in the first half is 64.2% and the full-year growth is expected to be quite robust.

Conclusion

Thus, the key to attaining a 9.5% real GDP annual growth in 2021-22 lies in the government’s ongoing emphasis on infrastructure spending as reflected in the government’s capital expenditure.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 3- Need for reforms in agriculture

Context

In the run-up to the repeal of the three farm laws, the potential cost of MSP to the taxpayers became a matter of debate.

Issue of MSP

- Large variation: Experts and agricultural economists quoted numbers about the cost of MPS.

- There is a large variation in the quoted numbers.

- The enormity of the variance in estimates is astounding.

- No consensus on the number of beneficiaries of MSP: There is also a dissonance between the NSSO data and the administrative data on the number of farmers who enjoy MSP.

- No consensus on a formula to calculate MSP: Further, there is no consensus on the formulae for the calculation of MSP.

Suggestions on land reforms

[1] Reduce high domestic prices

- That India is an agri-surplus country.

- That domestic prices of agri-commodities are often higher than in the international market and therefore, there is a need to bring them down.

- How to achieve cost reduction: Cost reduction can happen either by creating efficiencies by plugging leakages or, by cost-cutting — including reducing farmers’ margins.

- In the recently-reached understanding with the farmers, the government has agreed to constitute a committee on MSP.

- Hopefully, a formula can be arrived at by which costs of domestic agricultural produce can be reduced while ensuring a “remunerative price” for the farmers.

[2] Protecting landholdings

- There is also a need to protect landholdings.

- Farmers’ fears in this regard are not exaggerated.

- Under the erstwhile laws, orders of payment made by an SDM/Collector could be recovered as “arrears of land revenue”.

- While agricultural lands were protected from such recovery, non-agricultural (immovable and movable) assets appeared to be fair game.

- Further, circumstances such as sustenance and payment of debts could force a farmer to sell their agricultural landholdings.

- Large-scale loss of landholdings could lead to their consolidation in the hands of a few.

- This could have the impact of turning the clock back, reminiscent of the Zamindari system.

[3] Need to reconsider the dispute resolution mechanism

- The government should also reconsider the dispute resolution mechanism provided in the erstwhile laws.

- In an MSP driven regime, the government is likely to be a party in any potential dispute.

- Conflict of interest: There will be a direct conflict of interest since the SDM/Collector is an arm of the government.

- Land records are within the jurisdiction of the patwari and tehsildar, who report to the SDM/Collector.

- Fast track courts: It would be advisable to think in terms of fast-track courts, and remove the provision of recovery through arrears of land revenue.

- It would also be advisable to have only one dispute resolution mechanism for all farm laws.

[4] Avoid over-corporatisation without the creation of the requisite efficiencies

- We should not ask our farmers to brave corporatisation without levelling the playing field and enough jobs in the non-agricultural sector.

- Over-corporatisation without the creation of the requisite efficiencies could lead us to become heavily import-dependent, killing the benefits of the Green Revolution.

Conclusion

Perfunctory reforms and those that don’t work for all constituents — corporates as well as farmers — could have long-term deleterious effects for not only the agricultural sector, but the economy as a whole.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 2- Independence of Election Commission

Context

The Chief Election Commissioner and two Election Commissioners were summoned by the PMO to attend a meeting with the Principal Secretary to the PM.

Why the meeting raises questions?

- The PMO summoning or “inviting” not just the CEC but the full bench is in violation of the Constitution, irrespective of how important or urgent the issue.

- Violation of the principle of distancing from executive: When a person is appointed as CEC or EC, that person has to resign from his executive post in order to adhere to important constitutional principle of distancing from the executive/government.

- The executive could appoint a person to these posts but could not order them, or remove me because of the constitutional scheme of things.

- Violation of independence: An independent ECI is a gift of the Constitution to the nation. Free and fair and credible elections are sine qua non of the EC.

- The Supreme Court has repeatedly stressed this point, calling it part of the basic structure of the Constitution.

- Violation of warrant of precedence: The CEC is very high in the warrant of precedence — ninth, while the PS to PM is 23rd.

- How can such a high constitutional functionary be summoned to attend a meeting with an officer, howsoever high and mighty?

- It raises suspicions: A meeting of the PS to the PM, formal or informal, online or in the PMO or ECI, just before elections raises unnecessary suspicions.

Conclusion

This incident is a transgression that should not happen again. The distance of an arm’s length in interactions between institutions envisaged in the Constitution is sacrosanct. It should not only be maintained but also “seen” to be maintained.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: NA

Mains level: Prevention of Cruelty to Animals

The Supreme Court has allowed Maharashtra to hold bullock cart races in the state till the pendency of the matter before the Constitutional Bench of the apex court.

Allowing bullock-cart races

- The SC observed that the validity of the amended provisions of the Prevention of Cruelty to Animals Act, 1960 and the rules framed by Maharashtra provided for bullock cart race in the State.

- Such races would operate during the pendency of the petitions as the entire matter has been referred to a constitution Bench.

- The state govt has cited examples as the same is being conducted in the states like Tamil Nadu and Karnataka.

Why was there a ban on the bullock cart races?

Ans. Ban on Jallikattu, then

- Bullock cart races were banned in Maharashtra after the Supreme Court declared that the race as violative of the provisions of the central act in 2014.

- It then had observed that bulls were not anatomically designed to participate in races/taming and would be subjected to cruelty if used as a performing animal.

How did Maharashtra respond?

Ans. Bringing in a law to prevent pain or sufferings to the animals

- In April 2017, the Maharashtra assembly had passed legislation for resumption of bullock cart races across the state.

- The Bill titled ‘The Prevention of Cruelty to Animals (Maharashtra Amendment) Bill’ was passed unanimously with the support of all parties.

- As per the amendment, bullock cart races could be held with the prior permission of the district collector concerned by ensuring that no pain or suffering would be caused to the animal.

Why did the Maharashtra government go to SC?

Ans. Blanket ban by Bombay HC

- Even after this law, the Bombay High Court refused to vacate stay on the bullock cart races.

- Hence it got to approach the SC.

Proving the running ability of a bull

- In November 2017, the Maharashtra government set up a committee to study the running capacity of various breeds of bulls and bullocks in comparison to horses.

- The committee was asked to study physiological and biochemical changes during the running of the bulls, bullocks and horses.

- A report titled ‘Running ability of bull’ was prepared in two months by the government to justify allowing the bullock cart races.

- Subsequently, the Maharashtra government challenged the Bombay HC’s order.

Back2Basics: Jallikattu Debate

- It is a bull-taming sport and a disputed traditional event in which a bull such is released into a crowd of people.

- Multiple human participants attempt to grab the large hump on the bull’s back with both arms and hang on to it while the bull attempts to escape.

- Participants hold the hump for as long as possible, attempting to bring the bull to a stop. In some cases, participants must ride long enough to remove flags on the bull’s horns.

- It is typically practised in the state of Tamil Nadu as a part of Pongal (harvest) celebrations in January.

Issue with the sport

An investigation by the Animal Welfare Board of India concluded that “Jallikattu is inherently cruel to animals”.

- Human deaths: The event has caused several human deaths and injuries and there are several instances of fatalities to the bulls.

- Manhandling of animals: Animal welfare concerns are related to the handling of the bulls before they are released and also during the competitor’s attempts to subdue the bull.

- Cruelty to animal: Practices, before the bull is released, include prodding the bull with sharp sticks or scythes, extreme bending of the tail which can fracture the vertebrae, and biting of the bull’s tail.

- Animal intoxication: There are also reports of the bulls being forced to drink alcohol to disorient them, or chilli peppers being rubbed in their eyes to aggravate the bull.

Arguments in favour

- Native breed conservation: According to its protagonists, it is not a leisure sport available but a way to promote and preserve the native livestock.

- Cultural significance: Jallikattu has been known to be practiced during the Tamil classical period (400-100 BCE) and finds mention in Sangam texts.

- Man-animal relationship: Some believe that the sport also symbolizes a cordial man-animal relationship.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Nagoya Protocol, BDA, 2002

Mains level: Read the attached story

The government has introduced the Biological Diversity (Amendment) Bill, 2021 which seeks to facilitate access to biological resources and traditional knowledge by the Indian traditional medicine sector.

Biological Diversity Act, 2002: A quick recap

- The BDA, 2002 was enacted for the conservation of biological diversity and fair, equitable sharing of the monetary benefits from the commercial use of biological resources and traditional knowledge.

- The main intent of this legislation is to protect India’s rich biodiversity and associated knowledge against their use by foreign individuals.

- It seeks to check biopiracy, protect biological diversity and local growers through a three-tier structure of central and state boards and local committees.

- The Act provides for setting up of a National Biodiversity Authority (NBA), State Biodiversity Boards (SBBs) and Biodiversity Management Committees (BMCs) in local bodies.

- The NBA will enjoy the power of a civil court.

What are the proposed Amendments?

The bill seeks to reduce the pressure on wild medicinal plants by encouraging the cultivation of medicinal plants. The bill:

- Biological resources sharing: Exempts Ayush practitioners from intimating biodiversity boards for accessing biological resources or knowledge (Vaids and Hakims)

- Research promotion: Facilitates fast-tracking of research, simplify the patent application process

- Decriminalization: Decriminalises certain offences

- Bring in foreign investment: Seeks to bring more foreign investments in biological resources, research, patent and commercial utilisation, without compromising the national interest

Need for the Amendment

- Simplifying process: Concerns were raised by Ayush medicine, seed, industry and research sectors urging the government to simplify, streamline the profession.

- Easing compliance: They urged govt to reduce the compliance burden to provide for a conducive environment for collaborative research and investments.

- Access and Benefit-sharing: It also sought to simplify the patent application process, widen the scope of access and benefit-sharing with local communities.

- Exemptions: Ayush practitioners have been exempted from the ambit of the Act, a huge move because the Ayush industry benefits greatly from biological resources in India.

- Certain offences: Violations of the law related to benefit-sharing with communities, which are currently treated as criminal offences and are non-bailable, have been proposed to be made civil offences.

- Imbibing Nagoya Protocol: This bill provides to reconcile the domestic law with free prior informed consent requirements of the 2010 Nayogya Protocol on ABS.

Criticisms of the bill

- No consultation: The bill has been introduced without seeking public comments as required under the pre-legislative consultative policy.

- No profit-sharing: There are ambiguous provisions in the proposed amendment to protect, conserve or increase the stake of local communities in the sustainable use and conservation of biodiversity.

- Commercialization: Activists say that the amendments were done to “solely benefit” the AYUSH Ministry.

- Loopholes to Biopiracy: The Bill would mean AYUSH manufacturing companies would no longer need to take approvals.

- Ignoring Bio-utilization: The bill has excluded the term Bio-utilization which is an important element in the Act. Leaving out bio utilization would leave out an array of activities like characterization, incentivisation and bioassay which are undertaken with commercial motive.

- Exotic plants cultivation: The bill also exempts cultivated medicinal plants from the purview of the Act but it is practically impossible to detect which plants are cultivated and which are from the wild.

- De-licensing: This provision could allow large companies to evade the requirement for prior approval or share the benefit with local communities.

Back2Basics: Access and Benefit-Sharing

- India is a party to the Convention of Biological Diversity, and the Nagoya Protocol on Access and Benefit Sharing.

- It is mandated that benefits derived from the use of biological resources are shared in a fair and equitable manner among the indigenous and local communities.

- When an Indian or foreign company or individual accesses biological resources such as medicinal plants and associated knowledge, it has to take prior consent from the national biodiversity board.

- The board can impose a benefit-sharing fee or royalty or impose conditions so that the company shares the monetary benefit from commercial utilisation of these resources with local people who are conserving biodiversity in the region.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: WPA

Mains level: Wildlife Protection Amendment Bill

Forests Minister has introduced in Lok Sabha the Wildlife Protection (Amendment) Bill to ensure that the original 1972 Act complies with the requirements of the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES).

What the Amendment brings in?

[1] Standing Committee of State Board for Wildlife

- The Bill proposes reducing the number of schedules and establishing a Standing Committee of State Board for Wildlife.

- These committees will function like the National Board for Wildlife which is responsible for monitoring protected areas in the country and awarding or denying permission to projects in light of its threat to wildlife.

- Officials say that in most states, State Wildlife Boards fall under the responsibility of Chief Ministers, and are therefore neglected due to the paucity of time.

- The state Standing Committees will be able to take decisions on wildlife management and permissions granted for projects, without having to refer most projects to the NBWL.

[2] Seized Species

- There is also the insertion of a new section 42A about surrender of wild animals and products.

- Any article or animal surrendered under this Section shall become property of the State Government and the provisions of Section 39 shall be applicable to it.

[3] Reducing number of Schedules

- The Ministry has also rationalized Schedules for Wildlife under the Act, bringing it down from 6 to 4 major schedules.

- A schedule is a categorization of wildlife depending on how critically endangered they are.

- A schedule I category of wildlife (such as Tigers) are the highest protected under the Act.

[4] Wildlife Management Plans

- The Ministry has mandated that Wildlife Management Plans which are developed for sanctuaries and national parks across the country, will now become a part of the WPA.

- They will have to be approved by the Chief Wildlife Warden of the state.

- This will ensure far stricter protection to these protected areas. Earlier they would be protected through executive orders which did not have as much teeth.

Need for the Amendment

Ans. Blacklisting by CITES would affect trade in important plant species

- CITES aims to regulate the international trade of animals and plants so that it does not threaten their survival.

- This has been a long-standing demand from CITES for the past 25 years.

- India has been blacklisted by CITES once before, and if a second blacklisting were to happen — then India will no longer be able to trade in important plant specimens.

- This would affect the livelihood of a large section of Indian society that relies heavily on this trade.

About CITES

- CITES stands for the Convention on International Trade in Endangered Species of Wild Fauna and Flora.

- It is as an international agreement aimed at ensuring “that international trade in specimens of wild animals and plants does not threaten their survival”.

- It was drafted after a resolution was adopted at a meeting of the members of the International Union for Conservation of Nature (IUCN) in 1963.

- It entered into force on July 1, 1975, and now has 183 parties.

- The Convention is legally binding on the Parties in the sense that they are committed to implementing it; however, it does not take the place of national laws.

- India is a signatory to and has also ratified CITES convention in 1976.

CITES Appendices

- CITES works by subjecting international trade in specimens of selected species to certain controls.

- All import, export, re-exports and introduction from the sea of species covered by the convention has to be authorized through a licensing system.

It has three appendices:

- Appendix I includes species threatened with extinction. Trade-in specimens of these species are permitted only in exceptional circumstances.

- Appendix II provides a lower level of protection.

- Appendix III contains species that are protected in at least one country, which has asked other CITES Parties for assistance in controlling trade.

Back2Basics: Wildlife (Protection) Act, 1972

- WPA provides for the protection of the country’s wild animals, birds and plant species, in order to ensure environmental and ecological security.

- It provides for the protection of a listed species of animals, birds and plants, and also for the establishment of a network of ecologically-important protected areas in the country.

- It provides for various types of protected areas such as Wildlife Sanctuaries, National Parks etc.

There are six schedules provided in the WPA for protection of wildlife species which can be concisely summarized as under:

| Schedule I: |

These species need rigorous protection and therefore, the harshest penalties for violation of the law are for species under this Schedule. |

| Schedule II: |

Animals under this list are accorded high protection. They cannot be hunted except under threat to human life. |

| Schedule III & IV: |

This list is for species that are not endangered. This includes protected species but the penalty for any violation is less compared to the first two schedules. |

| Schedule V: |

This schedule contains animals which can be hunted. |

| Schedule VI: |

This list contains plants that are forbidden from cultivation. |

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Tamil Thai Vaazhthu

Mains level: Read the attached story

The Tamil Nadu Government has declared the Tamil Thai Vaazhthu as State Song.

The decision came after the Madras High Court ruling that there is no statutory or executive order requiring the attendees to stand up when Tamil Thai Vaazhthu is sung.

Tamil Thai Vaazhthu

- A part of the verses under the title ‘Tamil Dheiva Vanakkam’ from Manonmaniam, penned by Manonmaniam Sundaranar and published in 1891, eventually came to be known as the Tamil Thai Vaazhthu.

- In 1913, the annual report of the Karanthai Tamil Sangam made the demand for singing the song at all functions.

- The Tamil Thai Vaazhthu is being sung at Karanthai Tamil Sangam since 1914.

- It is also being sung at all Tamil Sangams associated with the Karanthai Tamil Sangam.

- The Karanthai Tamil Sangam had appealed to the then Chief Minister, C.N. Annadurai, to declare Tamil Thai Vaazhthu the State song.

What was the Madras HC observation?

- There is no statutory or executive order requiring attendees to stand up when it was being sung.

- The court, however, ruled that Tamil Thai Vaazhthu “is a prayer song and not an Anthem”.

- While the “highest reverence and respect ought to be shown”, it was not necessary to stand for it.

- The song is sung at the commencement (and not at the end) of all functions organized by government departments, local bodies and educational institutions.

What about National Anthem?

- In the Bijoe Emmanuel vs. State of Kerala (1986) Case, the Supreme Court ordered the readmission to school of three children who had been expelled for refusing to sing the national anthem.

- It was then noted by the SC that there is no provision of law which obliges anyone to sing the National Anthem.

- Again, the Supreme Court had, in Shyam Narayan Chouksey v. Union of India (2017), directed that all cinema halls shall play the national anthem before the film and all present are obliged to stand.

What is the state directive?

- TN CM has issued a directive that everyone who is present during the rendition of the song, barring differently-abled persons, should remain standing.

- The song should compulsorily be sung at the beginning of events organized by all educational institutions, government offices and public sector undertakings, among other public organizations.

- The song should be sung in 55 seconds in Mullaipaani Ragam (Mohana Raagam) in the thisra thaalaa.

- At public functions, the playing of the song with musical instruments/recordings is to be avoided, and trained singers should sing it.

Point of discussion: Is it a case of Sub-nationalism?

- There has been an intensification of sub-nationalism in India by highlighting the greatness of their state, language or historical state icons.

- This pride has, at times, led to unimaginable actions. The latest issue of contention was regarding a separate State flag for Karnataka.

- India also witnesses shocking developments showing the ugly face of provincialism in the North-East.

Issues with such tendencies

- Overambitious aspirations: As much as it is a matter of pride it remains a matter of concern when regional aspirations become too strong.

- Secessionist tendencies: India has already faced partition due to rising religious motives and has been plagued by secessionism in J&K and Nagaland based on regional identities.

- National Unity: It can be argued that subnationalism emphasizes aggressively on its regional identities then it can break the sensitive thread through which India remains a nation.

- Communalism: It should be critically studied that whether the state’s assertions are to freely exercise their own culture and language or to belittle and suppress others.

Affirmations to offer

- Pluralism: An optimistic view emerges which characterizes subnationalism as the strength of a multi-cultural nation such as India.

- Socio-economic solidarity: Subnationalism encourages social development as the level of solidarity is high in a state under such motives of state song, flag etc.

- Unification: State symbols means that a region becomes more and more homogenous and dedicated for welfare under cultural and linguistic symbolization.

Conclusion

- As long as subnationalism is not secessionist in nature or is aimed towards other communities, it might become a positive force in India.

- It will help in re-establishing the nature of the pluralistic society of India amidst the growing manufactured rhetoric of nationalism being falsely related exclusively with religious nationality.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Key terms in PDP Bill

Mains level: Personal Data Protection Bill

The Personal Data Protection Bill is in some aspects very similar with some differences to global standards such as European Union’s General Data Protection Regulation. Here is how:

Must read:

Draft Personal Data Protection Bill, 2021

Major similarities

[1] Consent

- EU: Users must have informed consent about the way their data is processed so that they can opt in or out.

- India: Processing of data should be done in a fair and transparent manner, while also ensuring privacy

[2] Breach

- EU: Supervisory authority must be notified of a breach within 72 hours of the leak so that users can take steps to protect information

- India: Data Protection Authority must be informed within 72 hours; DPA will decide whether users need to be informed and steps to be taken

[3] Transition period

- EU: Two-year transition period for provisions of GDPR to be put in place

- India: 24 months overall; 9 months for registration of data fiduciaries, 6 months for DPA to start

[4] Data fiduciary

- EU: Data fiduciary is any natural or legal person, public authority, agency or body that determines purpose and means of data processing

- India: Similar suggestions; additionally, NGOs which also process data to be included as fiduciaries

Differences:

[1] Anonymous information

- EU: Principles of data protection do not apply to anonymous information since it is impossible to tell one from another

- India: Non-personal data must come under the ambit of data protection law such as non-personal data

[2] Punishment

- EU: No jail terms. Fines up to 20 million euros, or in the case of an undertaking, up to 4 % of their total global turnover of the preceding fiscal year

- India: Jail term of up to 3 years, fine of Rs 2 lakh or both if de-identified data is re-identified by any person.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Types of subsidies

Mains level: Paper 3- MSP and challenges ahead at WTO

Context

Amid the demand for legal backing to MSP, the question remains about whether India can provide a legal guarantee violating its international law obligations enshrined in the Agreement on Agriculture (AoA) of the World Trade Organization (WTO)?

Classification of subsidies under AoA: Trade distorting and non-trade distorting

- The objective of AoA: One of the central objectives of the AoA is to cut trade-distorting domestic support.

- Three categories: In this regard, the domestic subsidies are divided into three categories: ‘green box’, ‘blue box’ and ‘amber box’ measures.

- Non-trade distorting: ‘Green box’ subsidies (like income support to farmers de-coupled from production) and ‘blue box’ subsidies (like direct payments under production limiting programmes subject to certain conditions) are considered non-trade distorting.

- Countries can provide unlimited subsidies under these two categories.

- Trade-distorting subsidies: Price support provided in the form of procurement of crops at MSP is classified as a trade-distorting subsidy and falls under the ‘amber box’ measures, which are subject to certain limits.

So, how do countries measure ‘amber box’ support?

- Compute AMS: To measure ‘amber box’ support, WTO member countries are required to compute Aggregate Measurement of Support (AMS).

- AMS is the total of product-specific support (price support to a particular crop) and non-product-specific support (fertilizer subsidy).

Understanding the de minimis limit

- Under Article 6.4(b) of the AoA, developing countries such as India are allowed to provide a de minimis level of product and non-product domestic subsidy.

- This de minimis limit is capped at 10% of the total value of production of the product, in case of a product-specific subsidy; and at 10% of the total value of a country’s agricultural production, in case of non-product subsidy.

- Subsidies breaching the de minimis cap are trade-distorting.

Possibility of India overshooting the de minimis limit

- Relation between MSP and AMS: The procurement at MSP, after comparing it with the fixed external reference price (ERP) — an average price based on the base years 1986-88 — has to be included in AMS.

- Widening gap between ERP and MSP: Since the fixed ERP has not been revised in the last several decades at the WTO, the difference between the MSP and fixed ERP has widened enormously due to inflation.

- According to the Centre for WTO Studies, India’s ERP for rice, in 1986-88, was $262.51/tonne and the MSP was less than this.

- However, India’s applied administered price for rice in 2015-16 stood at $323.06/tonne, much more than the 1986-88 ERP.

- Procuring all the 23 crops at MSP, as against the current practice of procuring largely rice and wheat, will result in India breaching the de minimis limit making it vulnerable to a legal challenge at the WTO.

- Even if the Government does not procure directly but mandates private parties to acquire at a price determined by the Government, as it happens in the case of sugarcane, the de minimis limit of 10% applies.

Way forward

- Peace clause: Although a permanent solution is nowhere in sight, the countries have agreed to a peace clause.

- The peace clause forbids bringing legal challenges against price support-based procurement for food security purposes even if it breaches the limit on domestic support.

- The peace clause is applicable only for programmes that were existing as of the date of the decision and are consistent with other requirements.

- India’s procurement for rice and wheat, even if it violates the de minimis limit, will enjoy legal immunity.

- However, India will not be able to employ the peace clause to defend procuring those crops that are not part of the food security programme (such as cotton, groundnut, sunflower seed).

- Move from MSP to income-based support: Arguably, India can move away from price-based support in the form of MSP to income-based support, which will not be trade-distorting under the AoA provided the income support is not linked to production.

- Supplement price-based support with income-based support: Alternatively, one can supplement price-based support (keeping the de minimis limit in mind) with an income-based support policy.

Conclusion

The Government needs to engage with the farmers and create an affable environment to convince them of other effective policy interventions, beyond MSP, that are fiscally prudent and WTO compatible.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Omicron variant

Mains level: Paper 2- Importance of data in dealing with pandemic

Context

Questions are being asked about India’s preparedness as the cases with the Omicron variant of the Coronavirus has been on the rise in the country.

Where does India stand?

[1] The Positives

- Addressing oxygen shortage: The extreme shortages of oxygen that we saw barely six months ago will hopefully not be a feature of a third wave.

- Vaccinated population: We have now vaccinated more than 50% of the adult population with both doses of vaccine, and approximately 85% have received one or two doses.

- Ramping up testing to deal with a spike should not require an increase in capacity.

- More vaccine doses: We have more vaccine doses than in May 2021 and the potential for oral antiviral therapy in the near future.

[2] The negatives

- Lack of data: An urgent and important one is the lack of publicly available data on the pandemic from Government sources, particularly in regard to testing, but also in terms of being able to correlate disease severity with age, prior medical conditions, locations and other variables.

- Data from the Indian Council of Medical Research (ICMR), India’s premier medical research agency, remains inaccessible.

- The National Centre for Disease Control (NCDC) has not responded.

- The CoWIN data contains valuable information but it is of little value for future planning and prediction unless it can be tied to testing data and clinical information at the level of individuals.

- ICMR data not correlated to CoWIN platform data: The Indian Council of Medical Research holds data on every COVID-19 test conducted in India.

- However, these data are not correlated to the vaccine data in the CoWIN platform.

- Data with States is inaccessible: Data on hospitalisations, etc. are apparently available at the State level, but seem inaccessible.

What we can know from the data about pandemic

- Infer the probability of reinfection: If we knew that a person had tested positive on successive tests separated by, say four months or more, with a negative test in-between, that would suggest a reinfection.

- We could then infer the probability of such a reinfection.

- Probability of vaccine breakthrough infection: With information about testing and vaccination status, we could compute the probability of a vaccine breakthrough event.

- To know the efficacy of single vaccine dose: By checking to see whether the positive test happened after the first but before the second dose of vaccine, or after the second dose, the relative efficacy of such single vaccine doses at preventing disease could be derived.

- Effect of the vaccine on disease severity: By examining symptoms reported after a vaccine breakthrough event, we could understand the extent to which vaccines reduce disease severity.

- Impact of new variant: Add to this a layer of sequence information, and we could study the impact of new variants.

Role of the volunteer organisation

- The most trustworthy and granular data on cases in India have resulted from the remarkable and public-spirited work of a volunteer organisation, Covid19India.org.

- Their work has now been taken over by several other voluntary groups, all operating on the same broad principles of data accessibility: covid19bharat.org, incovid19.org and covid19tracker.in.

Way forward

- Commitment towards data accessibility: We need to stress on data availability because this is the one area where a swift realignment is possible.

- The more widely data are shared, the greater the likelihood of integration of the rapidly shifting scientific frontier with clinical practice.

- Learning from the experience of South Africa: With the advantages of a relatively high-quality surveillance system among low- and middle-income countries (LMIC) countries, bolstered by a commitment towards transparency and data accessibility, South Africa’s rapid sharing allowed the world to prepare swiftly for the appearance of the highly mutated Omicron variant.

- It is clear that pre-emptive decisions on vaccination and other measures could be made faster and better if more integrated data were available.

Consider the question “Why availability and accessibility of data is important in dealing with the Covid-19 pandemic? What are the challenges facing health data accessibility in India?”

Conclusion

Now, more than ever before is the time for us to urgently reassess our attitude towards data for public health purposes and the role of national health agencies in sharing data, generated with public funds, with scientists in India and across the world.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Defence manufacturing in India

India’s defense exports have increased manifold from ₹1,521 crore in 2016-17 to ₹8,434.84 crore in 2020-21.

Note: This newscard provides substantial data about India’s defense exports and imports, which is highly relevant for mains and interview. Kindly bookmark this article.

India’s defense exports

- India has the strength of low-cost, high-quality production.

- The Government has set an ambitious target to achieve exports of about ₹35,000 crore ($5 billion) in aerospace and defense goods and services by 2025.

- The Defense Ministry has clarified that the names of the major defense items exported cannot be disclosed due to strategic reasons.

- To boost indigenous manufacturing, the govt had issued two “positive indigenization lists” consisting of 209 items that cannot be imported and can only be procured from domestic industry.

A significant achievement

- According to the latest report of the Swedish think tank Stockholm International Peace Research Institute (SIPRI), three Indian companies figure among the top 100 defence companies in the 2020 rankings.

- These include Hindustan Aeronautics Limited (HAL), Ordnance Factory Board and Bharat Electronics Ltd (BEL).

Yet India is a top importer

- While India remained among the top importers, it was also included in the Top 25 defence exporters.

- There was an overall drop in India’s arms imports between 2011-15 and 2016-20, according to another SIPRI report of 2020.

Items that India export

- India has supplied different types of missile systems, LCA/helicopters, multi-purpose light transport aircraft, warships and patrol vessels etc.

- It is also willing to export artillery gun systems, tanks, radars, military vehicles, electronic warfare systems and other weapons systems to IOR nations.

Major partners: South Asian Countries

- Vietnam is procuring 12 Fast Attack Craft under a $100 million credit line announced by India.

- It is also interested in Advanced Light Helicopters and Akash surface-to-air missiles.

- HAL has pitched its helicopters and the Tejas LCA to several Southeast Asian and West Asian nations and is in the race to supply the LCA to Malaysia.

- Discussions on the sale of BrahMos supersonic cruise missiles, jointly developed by India and Russia, are at an advanced stage with some Southeast Asian nations.

Steps taken by the Centre to boost defence production

- Licensing relaxation: Measures announced to boost exports since 2014 include simplified defence industrial licensing, relaxation of export controls and grant of no-objection certificates.

- Lines of Credit: Specific incentives were introduced under the foreign trade policy and the Ministry of External Affairs has facilitated Lines of Credit for countries to import defence product.

- Policy boost: The Defence Ministry has also issued a draft Defence Production & Export Promotion Policy 2020.

- Indigenization lists: On the domestic front, to boost indigenous manufacturing, the Government had issued two “positive indigenization lists” consisting of 209 items that cannot be imported.

- Budgetary allocation: In addition, a percentage of the capital outlay of the defence budget has been reserved for procurement from domestic industry.

Issues retarding defence exports

- Excess reliance on Public Sector: India has four companies (Indian ordnance factories, Hindustan Aeronautics Limited (HAL), Bharat Electronics Limited (BEL) and Bharat Dynamics Limited (BDL)) among the top 100 biggest arms producers of the world.

- Policy delays: In the past few years, the government has approved over 200 defence acquisition worth Rs 4 trillion, but most are still in relatively early stages of processing.

- Lack of Critical Technologies: Poor design capability in critical technologies, inadequate investment in R&D and the inability to manufacture major subsystems and components hamper the indigenous manufacturing.

- Long gestation: The creation of a manufacturing base is capital and technology-intensive and has a long gestation period. By that time newer technologies make products outdated.

- ‘Unease’ in doing business: An issue related to stringent labour laws, compliance burden and lack of skills, affects the development of indigenous manufacturing in defence.

- Multiple jurisdictions: Overlapping jurisdiction of the Ministry of Defence and Ministry of Industrial Promotion impair India’s capability of defence manufacturing.

- Lack of quality: The higher indigenization in few cases is largely attributed to the low-end technology.

- FDI Policy: The earlier FDI limit of 49% was not enough to enthuse global manufacturing houses to set up bases in India.

- R&D Lacunae: A lip service to technology funding by making token allocations is an adequate commentary on our lack of seriousness in the area of Research and Development.

- Lack of skills: There is a lack of engineering and research capability in our institutions. It again leads us back to the need for a stronger industry-academia interface.

Way forward

- Reducing import dependence: India was the world’s second-largest arms importer from 2014-18, ceding the long-held tag as the largest importer to Saudi Arabia, says 2019 SIPRI report.

- Security Imperative: Indigenization in defence is critical to national security also. It keeps intact the technological expertise and encourages spin-off technologies and innovation that often stem from it.

- Economic boost: Indigenization in defence can help create a large industry which also includes small manufacturers.

- Employment generation: Defence manufacturing will lead to the generation of satellites industries that in turn will pave the way for a generation of employment opportunities.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Right to be Forgotten

Mains level: Art 21 and its broad aspects

The Centre has informed the Delhi High Court that the Personal Data Protection Bill 2019 contains provisions related to the ‘right to be forgotten’.

Right to be Forgotten

- ‘Right to be forgotten’ is a fairly new concept in India where an individual could seek to remove or delete online posts which may contain an embarrassing picture, video or news articles mentioning them.

- It comes under the right to privacy which has been held to be a fundamental right by the Supreme Court under Article 21.

- In 2017, the Right to Privacy was declared a fundamental right by the Supreme Court in its landmark verdict.

Why in news?

- The Personal Data Protection Bill 2019 contains provisions related to the doctrine of ‘right to be forgotten’.

- It highlighted two judgments passed by the Orissa High Court and the Karnataka High Court where they have accepted the doctrine of the ‘right to be forgotten’ as an essential part of the ‘right to privacy’.

Mention in PDP Bill

- The PDP bill aims to set out provisions meant for the protection of the personal data of individuals.

- Clause 20 under Chapter V of this bill titled “Rights of Data Principal” mentions the “Right to be Forgotten.”

- It states that the “data principal (the person to whom the data is related) shall have the right to restrict or prevent the continuing disclosure of his personal data by a data fiduciary”.

- A data fiduciary means any person, including the State, a company, any juristic entity, or any individual who alone or in conjunction with others determines the purpose and means of the processing of personal data.

Implications

- Under the Right to be forgotten, users can de-link, limit, delete or correct the disclosure of their personal information held by data fiduciaries.

Other similar provisions

- Section 69A of the IT Act does provide for removal of “certain unlawful information” from an intermediary platform.

- It primarily applies to ‘national security and public order related issues’ only.

Also read:

Draft Personal Data Protection Bill, 2021

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: PMKSY

Mains level: Not Much

The Cabinet has given its approval to extend its umbrella scheme Pradhan Mantri Krishi Sinchayee Yojana for irrigation, water supply, groundwater and watershed development projects for another five years till 2026.

PM Krishi Sinchai Yojana

- The PMKSY was launched on 1st July, 2015 with the motto of “Har Khet Ko Paani”.

- It is being implemented to expand cultivated area with assured irrigation, reduce wastage of water and improve water use efficiency.

The scheme has basically combined three active projects under various ministries which is as follows:

- Accelerated Irrigation Benefit Program (Ministry of Water Resources)

- Integrated Watershed Management Program (Ministry of Rural Development)

- Farm Water Management Project of the National Mission on Sustainable Agriculture

Components of PMKSY

PMKSY seeks to provide a complete solution to farm level irrigation and assured irrigation for every farm

- It aims to integrate irrigation with the latest technological practices and cover more cultivable areas under assured irrigation

- Increase the implementation of water-saving technologies and precision irrigation which in other words can be said as More Crop Per Drop.

- PMKSY also targets the promotion of micro-irrigation in the form of sprinklers, rain-guns, drips, etc.

Advantages of Micro Irrigation

- Higher Profits

- Water Saving & Water Use Efficiency (WUE)

- Less Energy Costs

- Higher fertilizer-use efficiency (FUE)

- Reduced Labour Costs

- Reduce Soli Loss

- Marginal Solis & Water

- Efficient & Flexible

- Improved Crop Quality

- Higher Yields

Implementation of PMKSY

- Everything from planning and execution of plans is regionalized in PMKSY.

- District Irrigation Plans (DIPs) will identify the areas that require improved facilities in irrigation at block levels and district levels.

- State Irrigation Plan consolidates all the DIPs and it oversees the agricultural plans developed under the Rashtriya Krishi Vikas Yojana.

Funding pattern

- Funds will be allocated by the centre only if the state has prepared the district irrigation plans and the state irrigation plans.

- The state government’s share under PMKSY is 25% and rest is borne by the centre, with an exception for north-eastern states where contribution by the state government is 10%.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Sugarcane pricing mechanism

Mains level: Issues with Sugarcane Pricing

A World Trade Organization panel ruled that India violated international trade rules when it offered excessive subsidies for the production and export of sugar and sugarcane.

What did WTO say?

- Under WTO rules, India’s sugar subsidies are capped at a de minimis limit of 10% of the value of production.

- India’s policies were inconsistent with WTO rules that govern the levels at which nations can subsidize domestic agricultural production.

- WTO has asked it to withdraw its prohibited subsidies under the Production Assistance, the Buffer Stock, and the Marketing and Transportation Schemes within 120 days.

What was the complaint against India?

Australia, Brazil, and Guatemala said India’s domestic support and export subsidy measures appeared to be inconsistent with various articles against WTO’s:

- Agreement on Agriculture

- Agreement on Subsidies and Countervailing Measures (SCM)

- Article XVI (which concerns subsidies) of the General Agreement on Trade and Tariffs (GATT)

- Domestic Support: All three countries complained that India provides domestic support to sugarcane producers that exceed the de minimis level of 10% of the total value of sugarcane production.

- Various subsidies: They also raised the issue of India’s alleged export subsidies, subsidies under the production assistance and buffer stock schemes, and the marketing and transportation scheme.

- Notifying support: Australia accused India of “failing” to notify its annual domestic support for sugarcane and sugar subsequent to 1995-96, and its export subsidies since 2009-10.

India’s reply to WTO panel

- India rejected the panel’s findings as “erroneous”, “unreasoned”, and “not supported by the WTO rules”.

- It argued that the requirements of Article 3 of the SCM Agreement are not yet applicable to India.

- It has a phase-out period of 8 years to eliminate export subsidies under the agreement.

- India also argued that its mandatory minimum prices are not paid by the governments but by sugar mills, and hence do not constitute market price support.

Must read:

Sugarcane Pricing in India

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

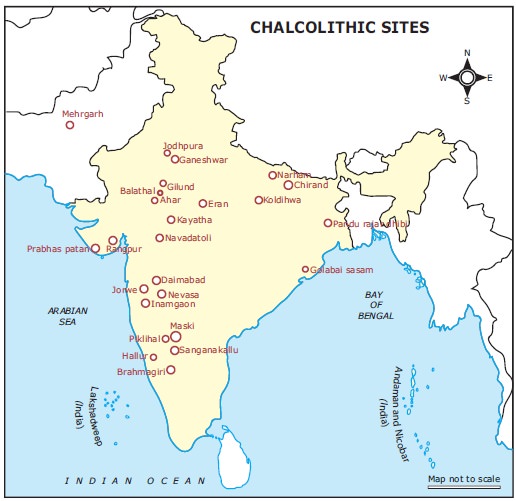

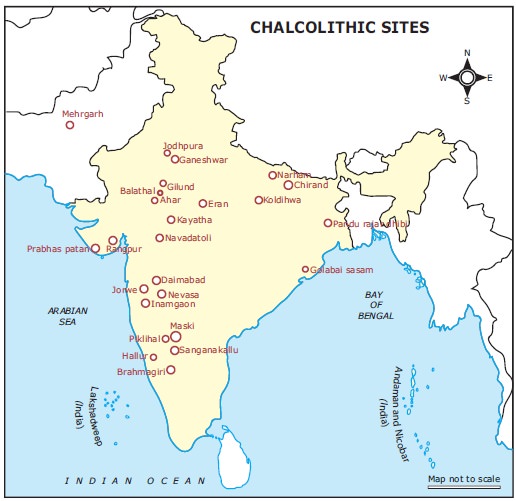

Prelims level: Chalcolithic culture in India

Mains level: Not Much

The Chalcolithic cultures of Central India are adequately investigated and studied informed the Ministry of Culture in particular reference to the sites of Eran and Tewar.

Major sites in Central India

[1] Eran (Dist. Sagar, MP )

- Eran (ancient Airikina) is situated on the left bank of the Bina (ancient Venva) river and surrounded by it on three sides.

- The recent excavation has unearthed a variety of antiquities including a copper coin, an iron arrowhead, terracotta bead, stone beads along with copper coins, stone celt, beads of steatite and jasper, etc.

- The occurrence of few specimens of plain, thin grey ware is noteworthy.

- The use of iron was evidenced by few metallic objects at the site.

[2] Tewar (Dist. Jabalpur, MP)

- Tewar (Tripuri) village is located 12 km west of Jabalpur district on Jabalpur – Bhopal highway.

- This excavation did not reach the natural soil and revealed four folds of cultural sequences i.e. Kushana, Shunga, Satvahana, and Kalachuri.

- Antiquarian remains in this excavation include viz remains of sculptures, hopscotch, terracotta balls, Iron nails, copper coins, terracotta beads, implements of Iron and terracotta figurine, ceramics red ware etc.

- It also revealed structural remains consist of brick wall and structure of sandstone columns.

Back2Basics: Chalcolithic Culture in India

- A completely different kind of culture known as Chalcolithic Culture was developed in central India and Deccan region by the end of the Neolithic period.

- It is characterized by the use of both stone and bronze implements.

Major Chalcolithic complexes in India

- Ahar culture c. 2,800-1,500 B.C.

- Kayatha culture c. 2,450-700 B.C.

- Malwa culture c. 1,900-1,400 B.C.

- Savalda culture c. 2,300-2,000 B.C.

- Jorwe culture c. 1,500 -900 B.C.

- Prabhas culture c. 2,000-1,400 B.C.

- Rangpur culture c. 1,700-1,400 B.C.

Important features

- The people of Chalcolithic culture had used unique painted earthenware usually black-on-red.

- The use of copper and bronze tools also evidenced on a limited scale.

- The economy was largely based on subsistence agriculture, stock-raising, hunting, and fishing.

- They, however, never reached the level of urbanization in spite they were using metal.

- They were contemporary of the Harappan culture, but some other were of later Harappan age.

Their locations

- The centers of Chalcolithic cultures flourished in semi-arid regions of Rajasthan, Madhya Pradesh, Gujarat, and Maharashtra.

- The settlements of Kayatha culture were mostly located on the Chambal River and its tributaries.

- The settlements of Malwa culture are mostly located on the Narmada and its tributaries.

- The three best known settlements of Malwa culture are at Navdatoli, Eran, and Nagada.

- Navdatoli was one of the largest Chalcolithic settlements in the country spread in almost 10 hectares.

- The settlements of Rangpur culture are located mostly on Ghelo and Kalubhar rivers in Gujarat.

- More than 200 settlements of Jorwe culture are known. Greater numbers of these settlements are found in Maharashtra.

- The best known settlements of Jorwe culture are Prakash, Daimabad, and Inamgaon. Daimabad was the largest one that measured almost 20 hectares.

Development of Agriculture

- They cultivated both Kharif and Rabi crops in rotation and also raised cattle with it.

- They cultivated wheat and barley in Malwa region. Rice was cultivated in Inamgaon and Ahar.

- They also cultivated jowar, bajra, kulth, ragi, green peas, lentil, and green and black grams.

- Largely, the Chalcolithic cultures flourished in the black cotton soil zone.

Trade and Commerce

- The Chalcolithic communities traded and exchanged materials with other contemporary communities.

- A large settlement serves as the major centers of trade and exchange.

- Some of them were Ahar, Gilund, Nagada, Navdatoli, Eran, Prabhas, Rangpur, Prakash, Daimabad, and Inamgaon.

- The Ahar people settled close to the copper source and were used to supply copper tools and objects to other contemporary communities in Malwa and Gujarat.

- Identical marks embedded on most of the copper axes found in Malwa, Jorwe, and Prabhas cultures that might indicate that it may be the trademarks of the smiths who made them.

- It is found that Conch shell for bangles was traded from the Saurashtra coast to various other parts of the Chalcolithic regions.

- Gold and ivory come to Jorwe people from Tekkalkotta in Karnataka and semiprecious stones may have been traded to various parts from Rajpipla in Gujarat.

- Wheeled bullock carts were used for long distance trade, besides the river transport. The drawings of wheeled bullock carts have been found on pots.

Try this PYQ from CSP 2019. It is dicey, but you cannot escape such questions.

Q. Which one of the following is not a Harappan site?

(a) Chanhudaro

(b) Kot Diji

(c) Sohgaura

(d) Desalpur

Post your answers here.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Not much

Mains level: Paper 3- High food prices in India and its implications

Context

The essential challenge of public policy for agriculture- the high price of food remains unsolved.

Implications of high food prices

- Increases poverty: A higher price of food increases poverty, especially as the rice and wheat supplied through the PDS constitute only a part of the total expenditure on food of the average Indian household.

- Reduces the expenditure on other item: For the household, a high price of food crowds out expenditure on other items ranging from health and education to non-agricultural goods.

- This prevents the market for non-agricultural goods from expanding.

- This was one of the first discoveries in economics, made by the English economist David Ricardo about two centuries ago.

Rising food prices in India

- An indication of the elevation of the price of food in an economy is the share of food in a household’s budget.

- In a global comparison we would find that this share is very large for India.

- Data from the U.S. Department of Agriculture (2016) show that this share ranges from over 30% for India to less than 10% for the U.S. and the U.K.

- This is in line with Ricardo’s understanding of how economies progress i.e., as food gets cheaper, growth in the non-agricultural economy is stimulated.

- Agricultural policy in India has remained quite unaccountable in the face of a rising relative price of food.

- Impact on manufacturing sector: Arguably, the high price of food has been a factor in the disappointing lack of expansion of the manufacturing sector in India despite repeated efforts to bring it about.

Changes needed in agricultural policy

- Both from the point of view of food security for low-income households and the dynamism of the non-agricultural sector, agricultural policy cannot ignore the price at which food is produced.

- Focus on improving the yield: The fact of low agricultural yield in India by comparison with the rest of the world has been known for long, and little is done about it.

- Management of soil nutrients and moisture: A superior management of soil nutrients and moisture, assured water supply and knowledge inputs made available via an extension service would be crucial.

- Raising yields will ensure profitability without raising producer prices, which will inflate the food subsidy bill.

How government intervention created problems

- Given the importance of food for our survival, this justifies public intervention in agriculture.

- The issue is the design and scale of this intervention.

- In the mid-sixties, when India was facing food shortage that could not be solved through trade, a concerted effort was made to raise domestic agricultural production.

- Profitability through MSP: It introduced the strategy of ensuring farm profitability though favourable prices assured by the state.

- Further, it entrenched the belief that it is the farmer’s right to have the state purchase as much grain as the farmer wishes to sell to the state agency.

- Created grain stockpile: This has resulted in grain stockpiles far greater than the officially announced buffer-stocking norm.

- These stocks have often rotted, resulting in deadweight loss, paid for by the public though taxes or public borrowing.

- Supply more than demand: Finally, with all costs of production reimbursable and all of output finding an assured outlet, supply has outstripped demand.

- Damage to natural environment: This has led to unimaginable pressure on the natural environment, especially water supply.

Consider the question “India faces the challenge of high food prices. Examine the ways in which high food prices affects the overall economy. How far is the India’s agriculture policy responsible for the problem?”

Conclusion

India needs an agricultural policy that ensures that farming is profitable but this cannot be at the cost of a high price of food. The ‘food problem’ should no longer be seen only in terms of the availability of food from domestic sources.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Fundamental duties

Mains level: Paper 2- Relation between fundamental duties and fundamental rights

Context

There has been growing advocacy for the integration of duty with rights. On Constitution Day last month, many Union Ministers used the occasion to underline this proposal.

What do rights come with duty mean?

- It is a basic proposition that all rights come with duties.

- But those duties are quite distinct from the meaning ascribed to them in the popular discourse.

- When a person holds a right, she is owed an obligation by a duty-bearer.

- For example, when citizens are promised a right against discrimination, the government is obliged to ensure that it treats everybody with equal care and concern.

- Similarly, the guarantee of a right to freedom of speech enjoins the state to refrain from interfering with that liberty.

Integrating rights with duties

- Proponents of integration of duty with rights aim to treat otherwise non-binding obligations — the “fundamental duties” as Article 51A describes them on a par with, if not superior to, the various fundamental rights that the Constitution guarantees.

- In an inversion of the well-known dictum, they see duties, and not rights, as trumps.

- On Constitution Day last month, many Union Ministers used the occasion to underline this proposal.

- The government puts forward an idea that our rights ought to be made conditional on the performance of a set of extraneous obligations.

Issues with the proposal

- This suggestion is plainly in the teeth of the Constitution’s text, language, and history.

- To the framers of the Constitution, the very idea of deliberating over whether these rights ought to be provisional, and on whether these rights ought to be made subject to the performance of some alien duty, was against the republic’s vision.

- Imposing duties a legislative prerogative: The Constitution’s framers saw the placing of mandates on individual responsibilities as nothing more than a legislative prerogative.

- For example, the legislature could impose a duty on individuals to pay a tax on their income, and this duty could be enforced in a variety of ways.

- If the tax imposed and the sanctions prescribed were reasonable, the obligations placed on the citizen will be constitutionally valid.

- In this manner, Parliament and the State legislatures have imposed a plethora of duties — duties to care for the elderly and for children; duties to pay tolls and levies; duties against causing harm to others; duties to treat the environment with care, the list is endless.

- Against Constitution: What is critical, though, is that these laws cannot make a person’s fundamental right contingent on the performance of a duty that they impose.

- A legislation that does so will violate the Constitution.

Background

- The fundamental duties that are now contained in Article 51A were introduced through the 42nd constitutional amendment.

- The Swaran Singh Committee, which was set up during the Emergency, and which recommended the insertion of the clause, also suggested that a failure to comply with a duty ought to result in punishment.

- Ultimately, the amendment was introduced after the binding nature of the clause was removed.

- In its finally adopted form, Article 51A encouraged citizens to perform several duties.

Way forward

- Know the precise nature of duties the rights create: The philosopher Onora O’Neill has argued with some force that we would do well to discuss the precise nature of duties that rights create.

- Unless we do so, our charters of human rights may not by themselves be enough.

- For example, we may want to ask ourselves if the promise of a right to free expression imposes on the state something more than a duty to forebear from making an unwarranted restriction on that liberty.

- Does it require the state to also work towards creating an equal society where each person finds herself in a position to express herself freely?

Consider the question “How fundamental duties are related to the fundamental rights in the context of the Indian Constitution? What are the issues with making the enforcement of rights contingent on adhering to the duties?”

Conclusion

When we speak about the importance of obligations, it is these questions that must animate our discussions. Should we instead allow the language of fundamental duties to subsume our political debates, we would only be placing in jeopardy the moral principles at the heart of India’s republic.

UPSC 2022 countdown has begun! Get your personal guidance plan now! (Click here)

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

Attend Now

Note4Students

From UPSC perspective, the following things are important :

Prelims level: Autonomous districts, Sixth Schedule

Mains level: Abrogation of Art. 370 and Ladakh

A ruling party MP from Ladakh has demanded that the region be included in the Sixth Schedule of the Constitution to safeguard land, employment, and cultural identity of the local population.

What is the Sixth Schedule?

- The Sixth Schedule under Article 244 provides for the formation of autonomous administrative divisions — Autonomous District Councils (ADCs).

- ADCs have some legislative, judicial, and administrative autonomy within a state.

- The Sixth Schedule applies to the NE states of Assam, Meghalaya, Mizoram (three Councils each), and Tripura (one Council).

Composition of ADCs

- ADCs have up to 30 members with a term of five years.

- It can make laws, rules and regulations with regard to land, forest, water, agriculture, village councils, health, sanitation, village- and town-level policing, inheritance, marriage and divorce, social customs and mining, etc.

- The Bodoland Territorial Council in Assam is an exception with more than 40 members and the right to make laws on 39 issues.

Why does Ladakh want to be part of the Sixth Schedule?

- Local aspirations: There was much enthusiasm initially, mostly in Leh, after the repeal of Art. 370 which created two new UTs.

- Negligence in erstwhile J&K state: Buddhist-dominated Leh district had long demanded UT status because it felt neglected by the erstwhile state government.

- Denial of Legislature: The enthusiasm waned as it was understood that while the UT of J&K would have a legislature, the UT of Ladakh would not.

- Inadequate representation: The administration of the region is now completely in the hands of bureaucrats with only 1 MP.

- New domicile criteria: The changed domicile policy in Jammu and Kashmir has raised fears in the region about its own land, employment, demography, and cultural identity.

- Statehood demands: A coalition of social, religious, and political representatives in Leh and Kargil has demanded full statehood for Ladakh.

Cultural significance of Ladakh

- Ladakh is historically perceived as a cosmopolitan region with centuries of multiple cultural settings.

- It was an Asian pivot – the people here traversed diverse cultural boundaries and engaged with ideas.

Can Ladakh be included in Sixth Schedule?

- NCST Recommends: In September 2019, the National Commission for Scheduled Tribes recommended the inclusion of Ladakh under the Sixth Schedule.

- Distinct culture: It was predominantly tribal (more than 97%), people from other parts of the country had been restricted from purchasing or acquiring land there, and its distinct cultural heritage needed preservation.

Legal hurdles