Why in the News

Researchers at the Institute of Nano Science and Technology (INST) Mohali, have developed novel electrochemical and optical sensors using a new group of nano polymer materials.

About the Novel Nanopolymer:

Novel nanopolymers are innovative polymer materials that incorporate nanostructures or nanoparticles to impart unique properties.

- They are prepared using various methods like vapor condensation, vacuum evaporation, electrospinning, and chemical synthesis to create nanofibers, core-shell structures, hollow fibers, and tubes with diameters down to a few nanometers.

- Examples: Silicon nanospheres that are much harder than regular silicon, with hardness between sapphire and diamond, and bio-based N-heterocyclic poly(aryl ether ketone) with high biomass content and superior properties

- Applications of Novel Nanopolymers:

- Biosensors and optoelectronics utilizing the fluorescence and magnetic properties of nanoparticles.

- Drug delivery, tissue engineering, and gene therapy using biodegradable nanoparticle systems.

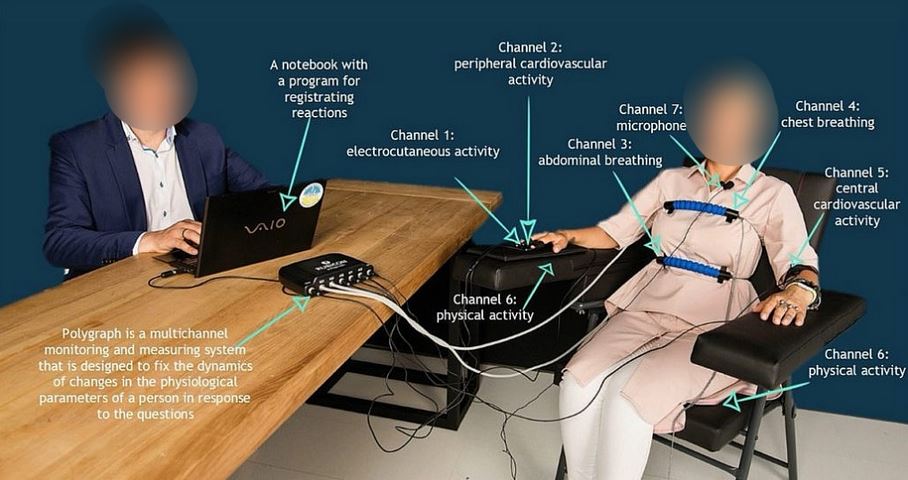

- Forensics for drug detection, fingerprinting, DNA analysis, and sensors.

- High-temperature-resistant plastics with improved properties.

These are the Novel Nanopolymers developed by INST:

| Metal-Organic Frameworks (MOFs) | 2-dimensional (2D) Materials | |

| Details | Crystalline materials with metal ions and organic ligands form porous structures. | Materials a few atomic layers thick with unique electrical, optical, and mechanical properties. |

| Surface Area | Extremely high (over 10,000 m²/g), ideal for adsorption. | High surface-to-volume ratio, enhancing interactions for sensing and energy storage. |

| Versatility | Customizable for gas storage, separation, catalysis, and sensing. | Functionalizable for bio-sensing and environmental monitoring. |

| Properties | High porosity and stability in harsh environments. | Excellent conductivity, flexibility, and strength, useful in electronics and optoelectronics. |

| Sensing Applications | Detects gases, toxins, and biomarkers with high sensitivity. | Detects gases, biomolecules, and pollutants quickly and efficiently. |

| Examples | Various MOFs designed for specific uses. | Includes graphene, MoS2, MXenes. |

PYQ:[2015] With reference to the use of nanotechnology in health sector, which of the following statements is/are correct? 1. Targeted drug delivery is made possible by nanotechnology. 2. Nanotechnology can largely contribute to gene therapy. Select the correct answer using the codes given below: (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 |